Oct 17, 2023 By Susan Kelly

Everyone isn't obsessive about keeping their vehicle spotless. When money is tight, a little bit of damage might be overlooked. If the damage is minor, you can probably get away without getting it fixed. This does not negate the need for auto insurance, though. However, several elements will determine whether or not an already damaged car may be insured.

Car Insurance Won't Cover Prior Damage

Right off the bat: A new auto insurance policy will never pay for repairs done in the past. Suppose you decide to purchase a secondhand automobile from a buddy. To bring down the cost of auto insurance, your buddy opted for a $1,000 deductible on both comprehensive and collision coverage.

When a deer smacked into the car, it ricocheted off the back quarter panel and left a substantial dent. With a $1,000 deductible, insurance will not cover the $900 necessary for the repair. Your friend is selling you the car because he doesn't want to spend money fixing it.

Available Insurance Protection

Regardless of the condition of your car, you may still obtain legally mandated liability coverage. That's because legal responsibility insurance won't fix your automobile if it is wrecked. However, it shields vehicle operators from liability for harm to other parties' property or people.

Check that the damage to your car doesn't pose any safety risks. Your insurance premiums or deductibles may increase significantly if your vehicle's airbag or main frame has been damaged.

If you can afford it, it's wise to have liability insurance with limits of at least $100,000 and preferably $300,000. In this scenario, your insurance company may only pay up to $300,000 in total claims, with a maximum payout of $100,000 per individual.

Disapproval Is Painful

Many recommended insurance companies may refuse to give physical damage coverage for a vehicle with any damage more than cosmetic. Both comprehensive and collision insurance are considered bodily damage coverage.

Accident Insurance:

If you or another driver hits an immovable object or another vehicle and causes damage to your car, collision insurance can help pay the costs.

Full Protection:

Claims that are not the result of an accident are covered by comprehensive insurance. The cost of repairs, less your deductible, will be covered by comprehensive insurance if you hit a deer, have a car fire, are a victim of theft or vandalism, or suffer damage to your vehicle due to weather.

Coverage Alternatives for Actual Damage

Finding an insurance company willing to cover physical damage on a vehicle that has already been damaged will be challenging. Non-standard insurance companies might offer you better rates. A non-standard insurance provider actively seeks out high-risk drivers, who it insures at premium prices. Be aware of the following if you decide to look into insurance:

Never Hide The Cost of Repairs:

To avoid further damage, please do not try to conceal the existing state. You don't want insurance fraud investigators knocking on your door. Neither the potential harm nor the inconvenience is justifiable.

A Harm Agent:

Most insurance companies need photos or videos of the damage. Perhaps they'll provide a form for you to fill out with a detailed account of the damage. The insurance adjuster will need to see the car in person and take pictures of the damage.

Making A Claim:

The insurance company will already know about the previous harm if you decide to submit a claim. We won't pay to fix the damage that was already there.

What Happens If You File a Claim Without Disclose Previous Damage

Surely you must not freak out! It's not unheard of to submit a claim for a large amount of money, although your car has just minor damage that hasn't been addressed. Those who work in the insurance industry as adjusters have seen it all.

An adjuster can usually tell the difference between the present damage and the previous harm. Keep a straight face at all times. Ensure the insurance company knows about any prior damage to your vehicle. It would help if you were as forthright as possible about what happened.

Your claim might be resolved in one of two ways:

Multiple Protections:

The claims adjuster may conclude that two claims are required to cover the combined costs of the current and past damages. If you had the correct coverage on your insurance at the time of the earlier injury, you would pay two deductibles and get everything fixed at once.

Ignore Past Damage

If you tell the adjuster, you aren't worried about the old damage, they may advise the body shop to ignore it. For this specific incident, we can only fix what was broken; nonetheless, you will be responsible for the deductible.

Sometimes unusual circumstances arise that need you to claim your auto insurance. Many things may go wrong with a vehicle, and each set of conditions is unique.

-

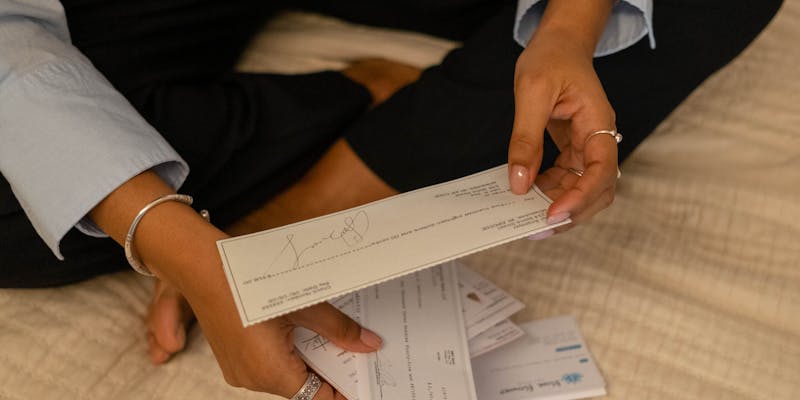

Postdated Checks: What They Are and Can They Be Deposited?

Jul 29, 2024

-

Top Alternatives to Robinhood: Best Apps for Former Users

Jul 31, 2024

-

Leasing Options For Your LLC in 2023

Feb 05, 2024

-

What You Need to Know About Getting Auto Insurance After a Claim

Oct 17, 2023

-

Best for You: Venmo vs. PayPal?

Dec 17, 2023

-

The Best Affordable Car Insurance For Teens

Dec 03, 2023

-

A Quick Guide: How Credit Card Miles Work?

Dec 26, 2023

-

Websites to Make Money Online

Dec 20, 2023

-

What is credit card consolidation?

Jan 04, 2024

-

How To Find Real Estate Investors?

Feb 04, 2024

-

Bank of England: CBDC brings opportunities and challenges, and the government should design it together.

Nov 24, 2023

-

RealEstateU Review: A Complete Analysis

Feb 12, 2024